Apple, Google, Maps, and Mobile

/On a more prosaic level, I think Apple's misstep has highlighted for many of us how hard it is to provide quality mobile services like Maps and how well Google really has done. This realization is apparently driving some iPhone stalwarts to consider an Android phone for the first time.

Despite

all the news and analysis, something has been missing from the dialog, however.

We’ve noticed very little talk regarding how Apple’s Maps affects Google’s

bottom line. Why is that? As an example, The New York Times had a solid article

on this topic that suggested that 25% of Google Maps users are on iOS, but was vague

when describing actual revenues.

The

reason for this is that Google Maps on iOS was more or less closed and likely

contributed very little to Google’s revenues. The legacy app can find a

specific address or category of business (like “pizza”) for you and give

contact details and directions, but nothing more. While Google Maps on the

iPhone was revolutionary only a few years ago, it now seems very limited on

that platform: no photos, no special offers, no “from the business” summaries,

no check-ins, no reading (or writing) reviews, and no advertising.

The

optimized version of Google Maps on the Android platform does have all of these extra features (and more), but I believe

that it also contributes very little revenue to Google. The most common use

cases involving Maps from a phone very rarely lead back to Google’s primary

money maker: paid search. Maps, regardless of the platform, tend to be closed

systems. While users might begin with traditional search and then be led to a

maps application, once there, users very rarely need to leave maps to complete

their task.

So, if it’s not revenue,

then what is at stake here?

This maps-clash is much more about strategic positioning than it is about immediate revenue. A big driver for the Apple/Google Maps split was ownership of behavioral data. Without its own maps app, Apple has had a diminished command of geo-behavioral data.

This maps-clash is much more about strategic positioning than it is about immediate revenue. A big driver for the Apple/Google Maps split was ownership of behavioral data. Without its own maps app, Apple has had a diminished command of geo-behavioral data.

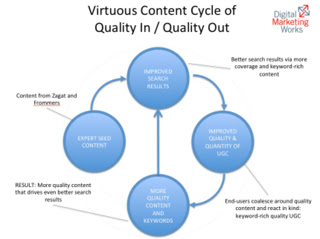

Replacing Google Maps with their own app will bring Apple data that informs its mobile strategy and (my prediction) will lead to Apple “innovating” a local-business “Offers” program that is similar to what Google has today on Android. Expect such a platform to include location-based targeting to be married to iAd and perhaps integration with a sexy payment platform like Square (which is largely designed by ex-Apple employees), and Apple’s Passbook service. The challenge, of course, is that Google has an enormous head start in this area.

At the end of the day, here's our take on what has transpired and what we can expect from this event...

- Apple is the short-term loser here: The weak user experience with a vital application diminishes user trust and nudges some users closer to the Google / Android ecosystem.

- But, Apple's Map will improve quickly: We should note that Maps is not inherently "terrible". A more fair description is "it's got good bones and simply needs more time to develop". Remember it is very hard to provide this kind of service at Google's level of quality. It will take time.

- Regardless, Google will counter quickly: Google has already revealed they are working on a dedicated app. Using Google’s new YouTube app for iOS as an example, we can expect that their new Google Maps app for iOS will also be a huge improvement and another chart topper in terms of downloads for iOS

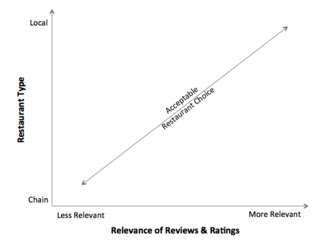

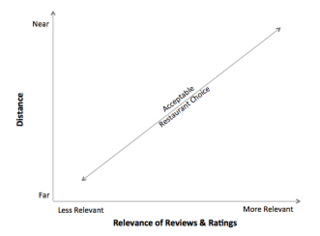

- (More) Fragmentation: Eventually, brands (especially hotels and restaurants) will need to optimize for Apple Maps -- just like they do in Google. And, just like with Google, expect lots of pain on the brand side, including weak B2B customer support from Apple, and general challenges in getting your listings right. Important Note: The importance of optimizing in Apple Maps will be in parallel to the amount of walk-in or direct-call business of a given hotel or restaurant.

- Yelp is the big short term winner here. As the source of all of the local business content (reviews, photos, etc.) + outgoing links back to its own site, Yelp is going to win big for now. Hotels and restaurants should place increased strategic value in optimizing for Yelp, and also for OpenTable (reservations) and even Facebook (check-ins). That 25% of Google Maps users has to go somewhere, and Apple will further tie functionality between its Maps and these third parties. I predict a big uptick in check-ins overall.

By Aaron Zwas --

Director of Emerging Technologies at Digital Marketing Works